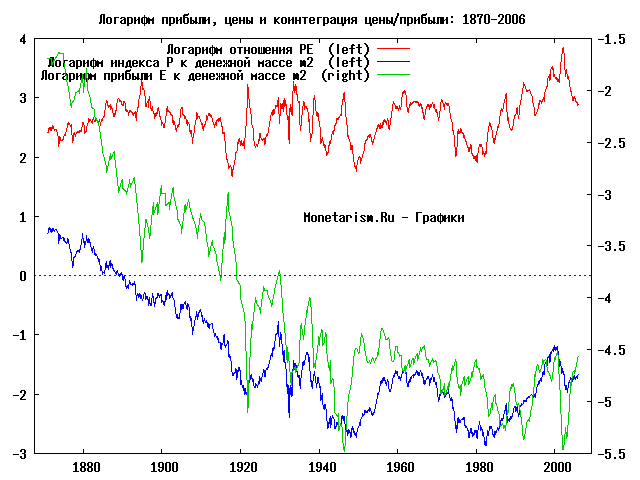

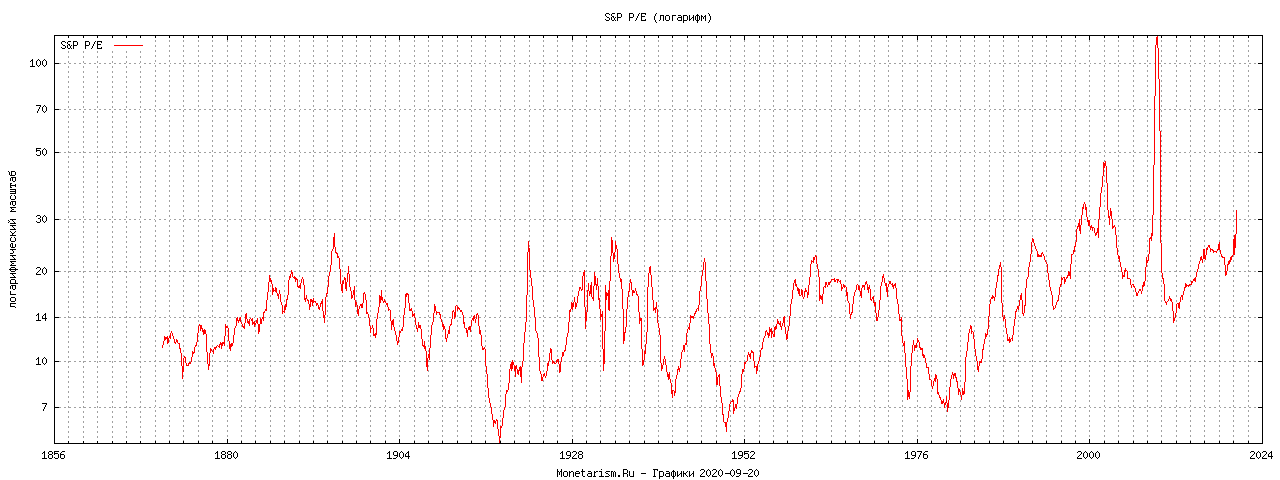

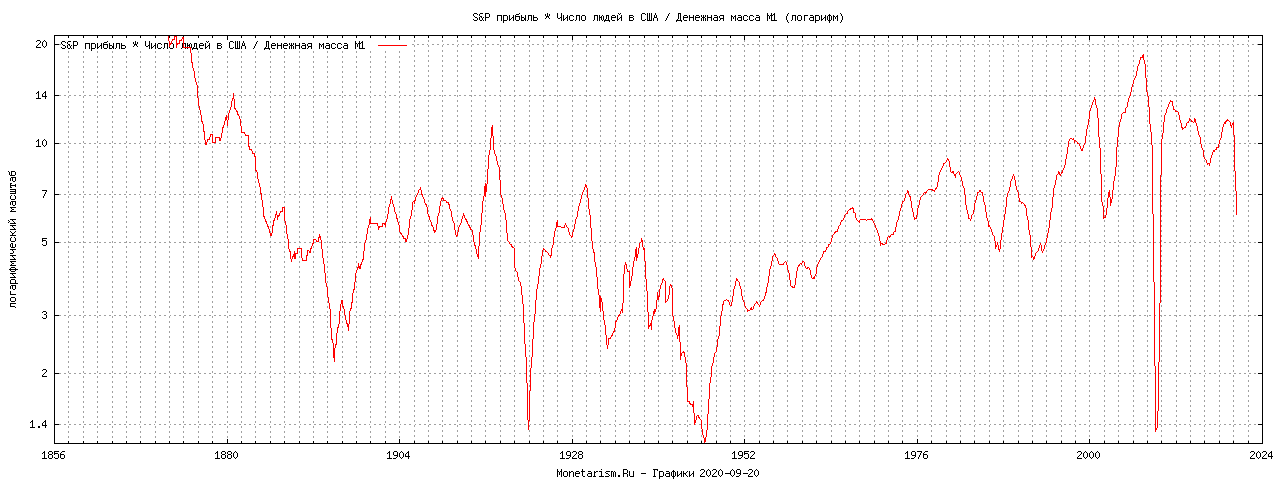

SP E 1870

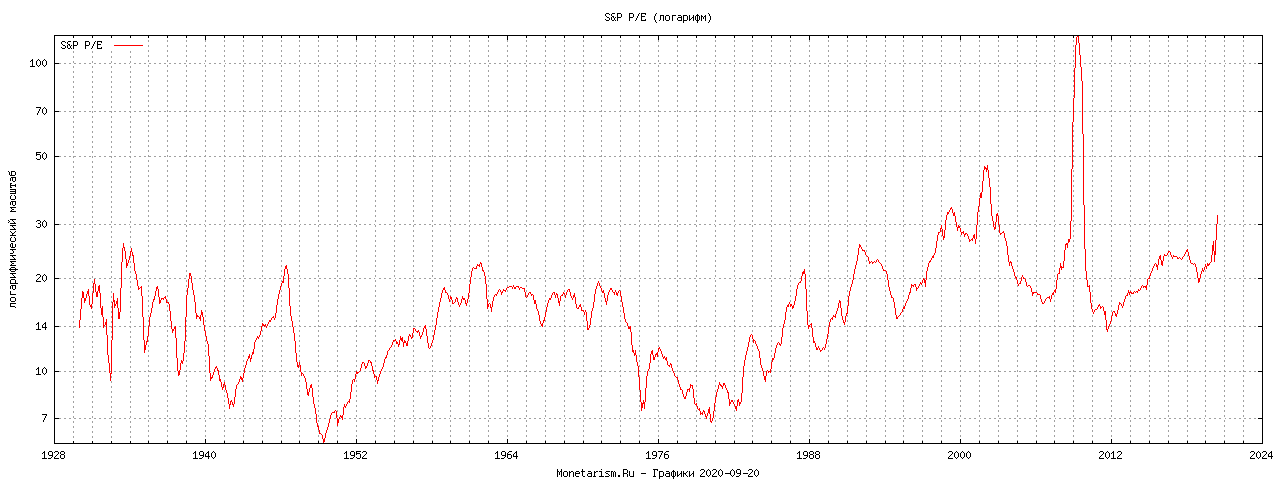

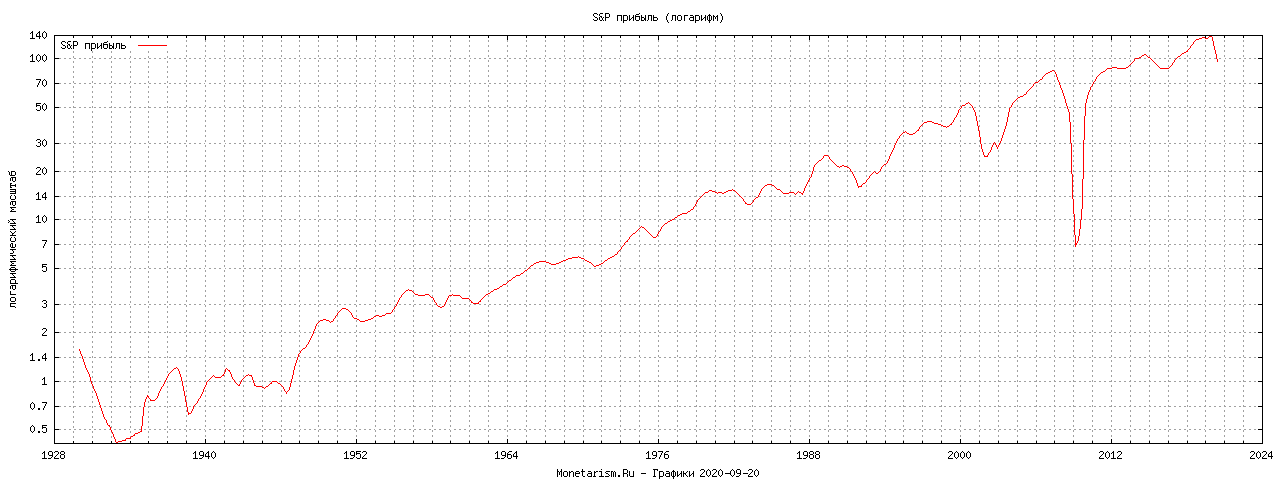

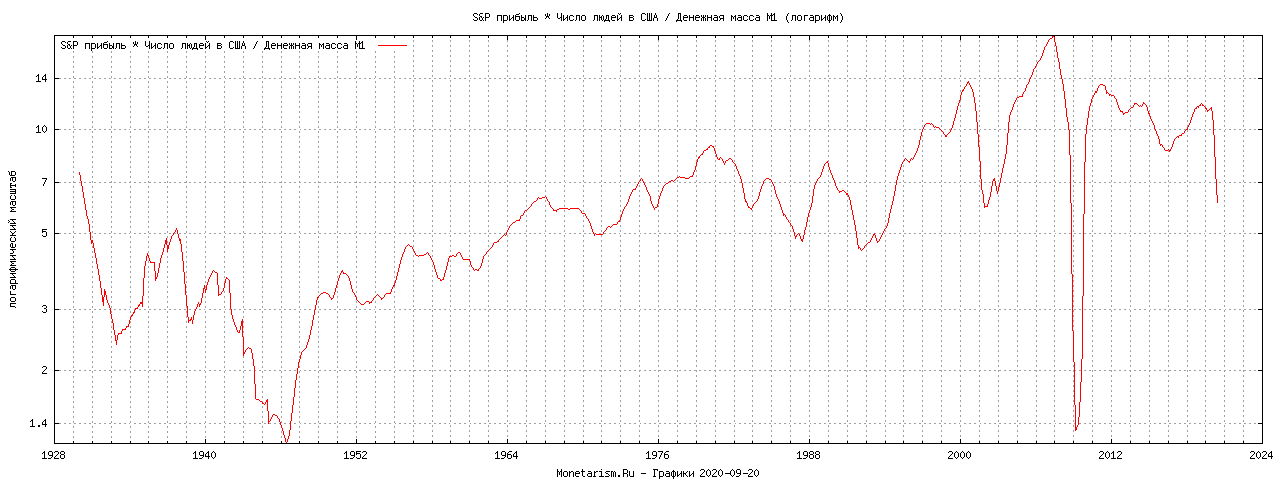

SP E 1930

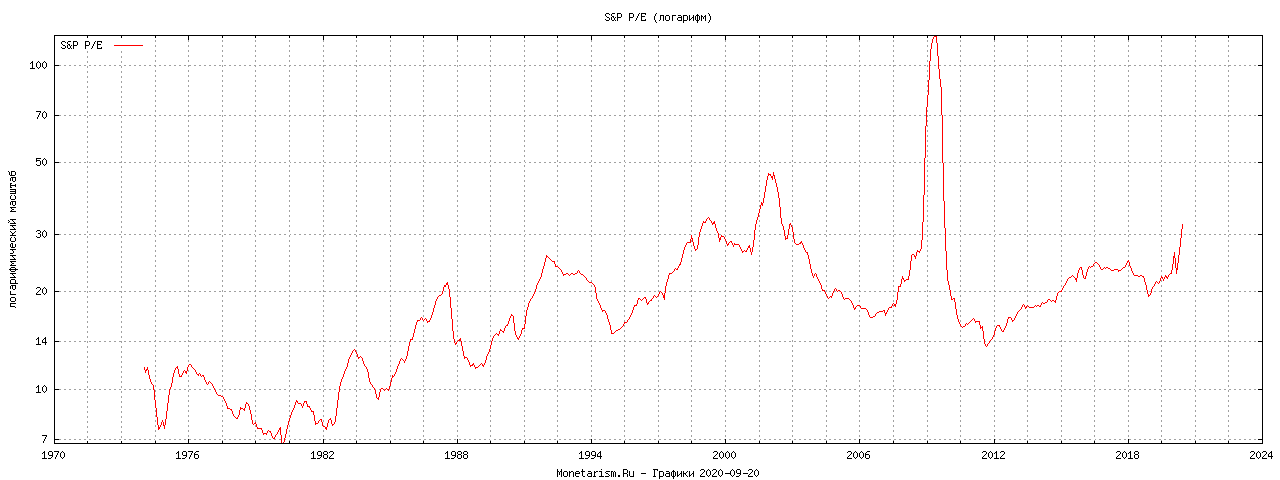

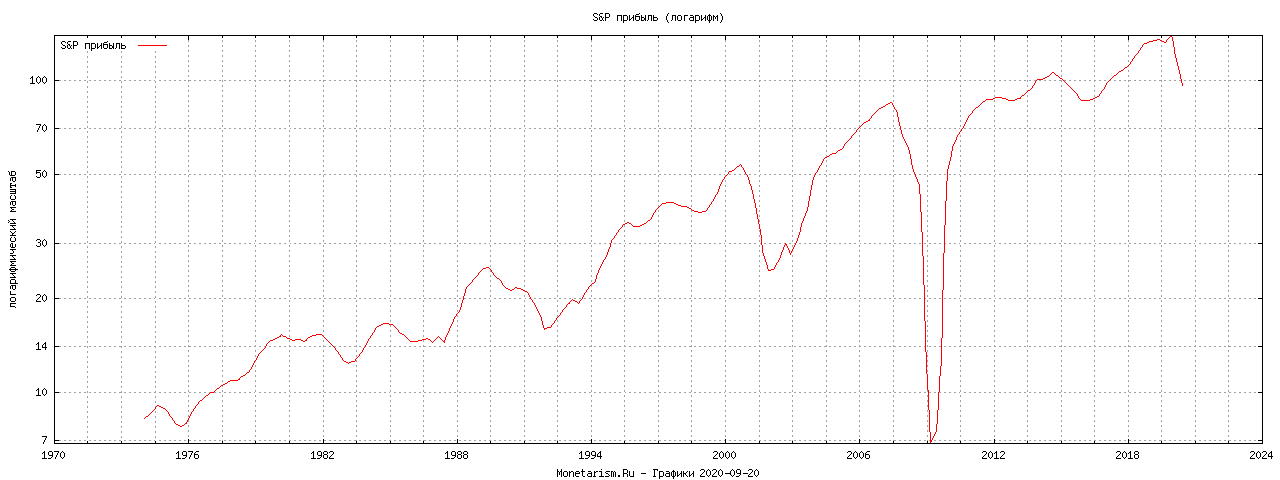

SP E 1974

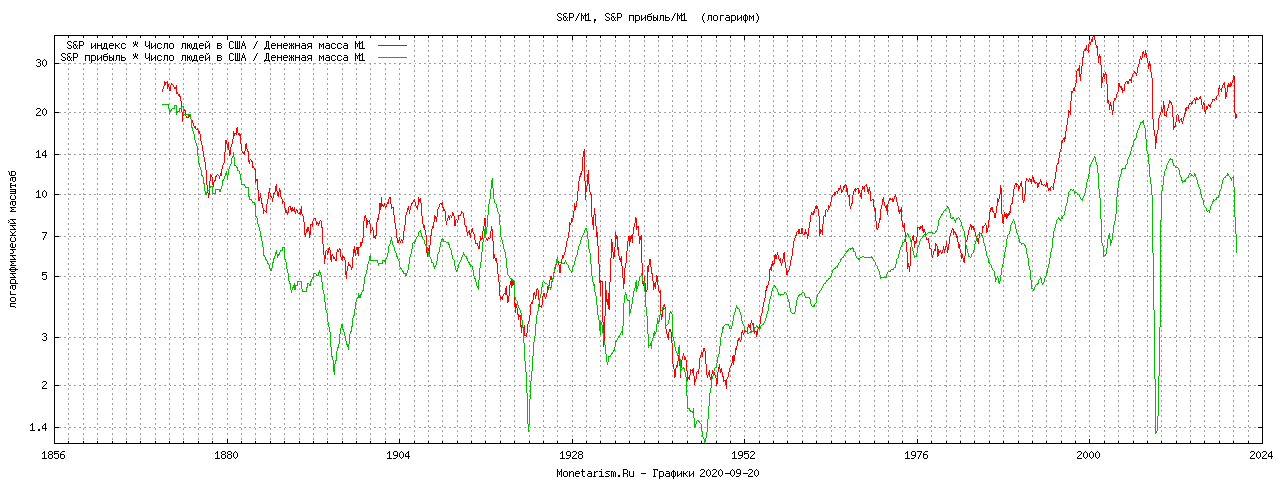

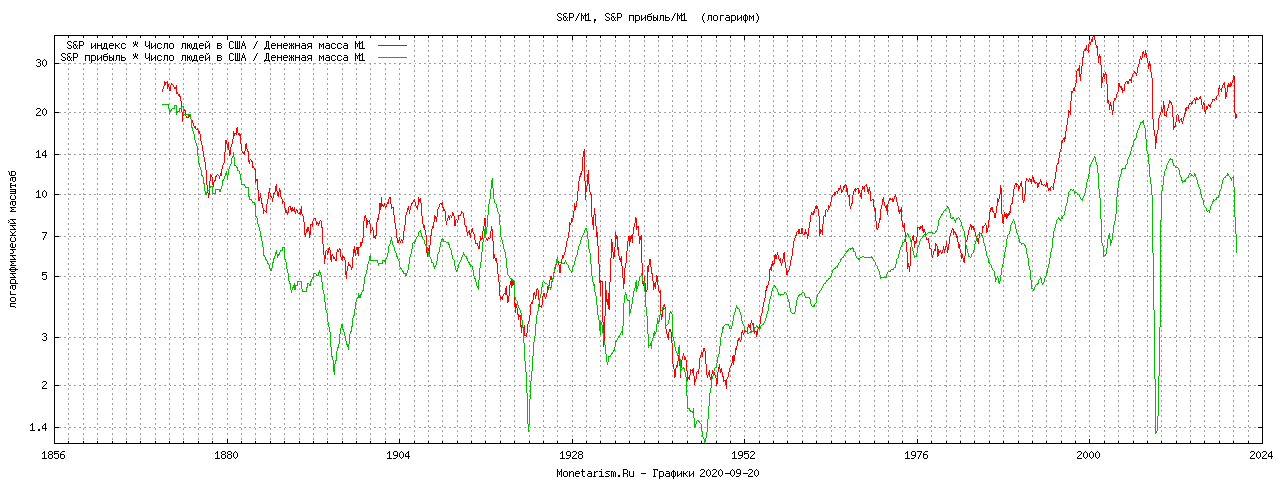

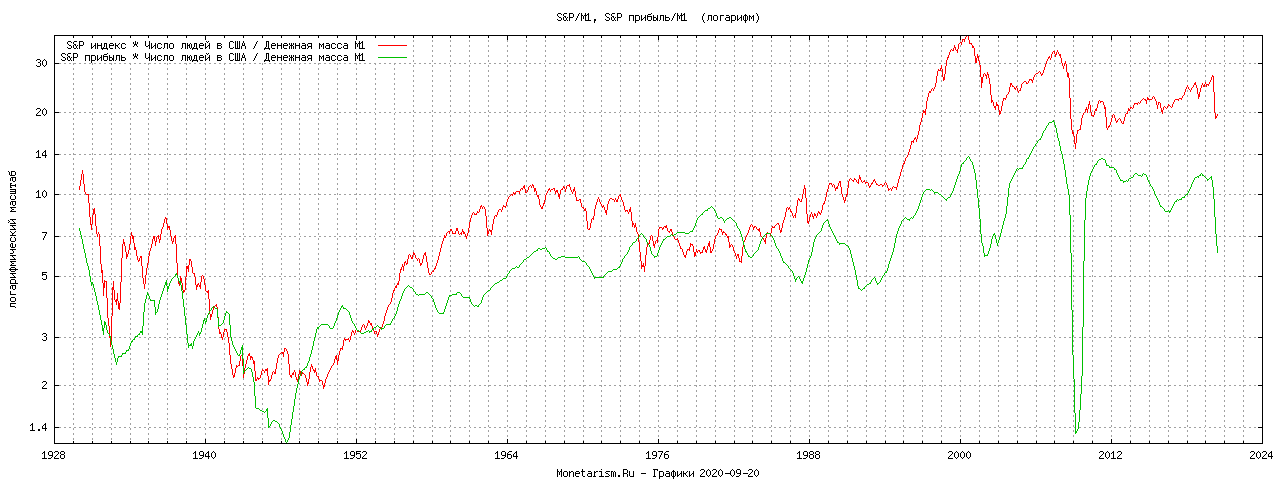

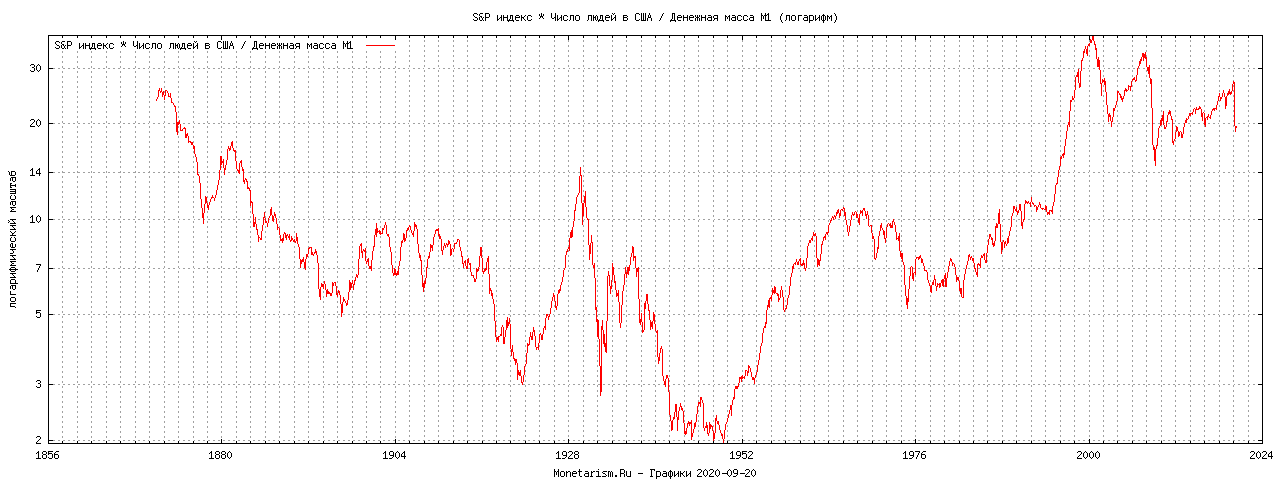

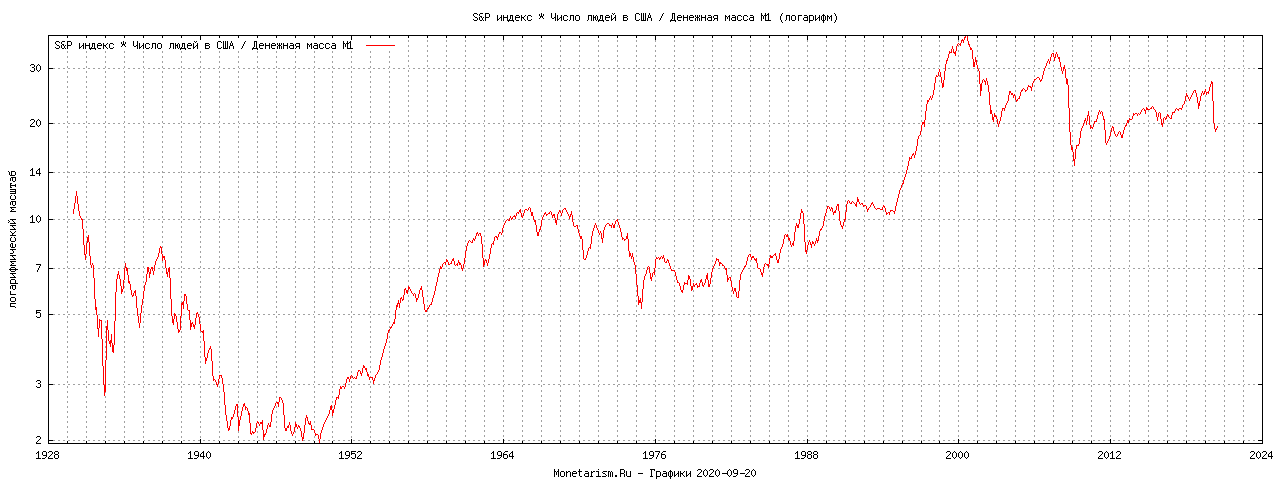

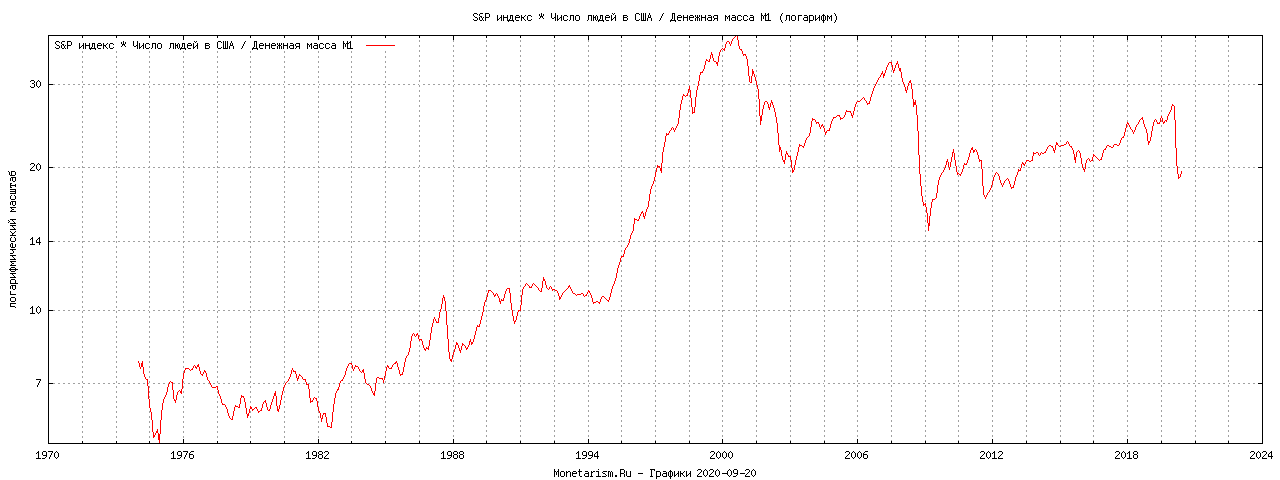

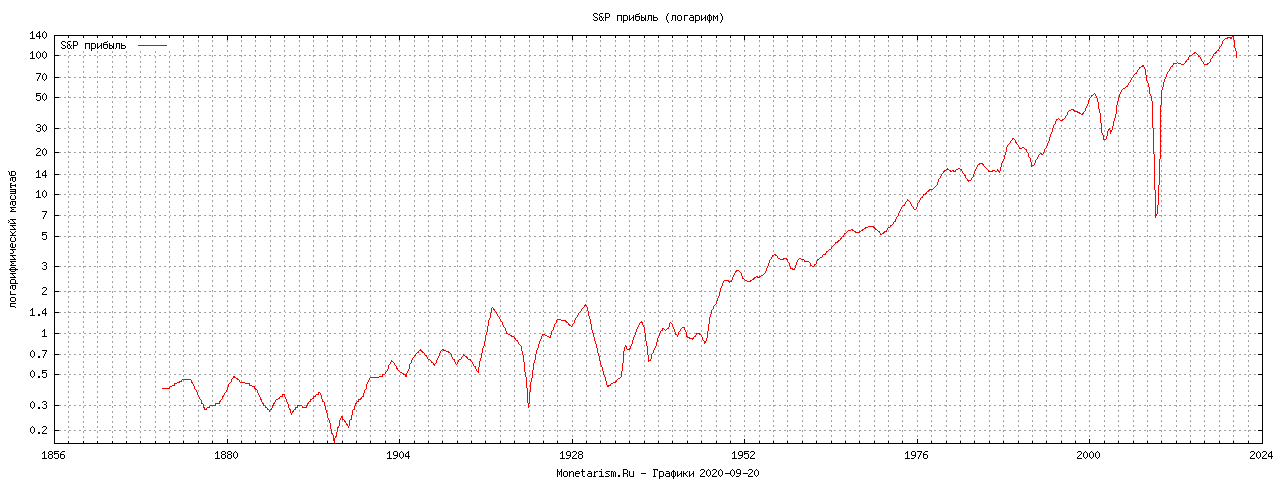

Графики отношения логарифма цены индекса и совокупной прибыли индекса с 1870 до 2006 года с учетом денежной массы М2 для американского рынка ценных бумаг (S&P 500)

Месячные данные. Обновление раз в год.

Коинтеграция коэффициента P/E

Step 3: cointegrating regression

Cointegrating regression -

OLS estimates using the 1620 observations 1871:01-2005:12

Dependent variable: l_P_m2

VARIABLE COEFFICIENT STDERROR T STAT P-VALUE

const 2,36418 0,0351011 67,353 < 0,00001 ***

l_E_m2 0,931760 0,00852611 109,283 < 0,00001 ***

Unadjusted R-squared = 0,880685

Adjusted R-squared = 0,880612

Durbin-Watson statistic = 0,0171285

First-order autocorrelation coeff. = 0,991544

Step 4: Dickey-Fuller test on residuals

Augmented Dickey-Fuller tests, order 12, for uhat

sample size 1607

unit-root null hypothesis: a = 1

test without constant

estimated value of (a - 1): -0,0121636

test statistic: t = -3,81563

asymptotic p-value 0,002093

P-values based on MacKinnon (JAE, 1996)

There is evidence for a cointegrating relationship if:

(a) The unit-root hypothesis is not rejected for the individual variables.

(b) The unit-root hypothesis is rejected for the residuals (uhat) from the

cointegrating regression.

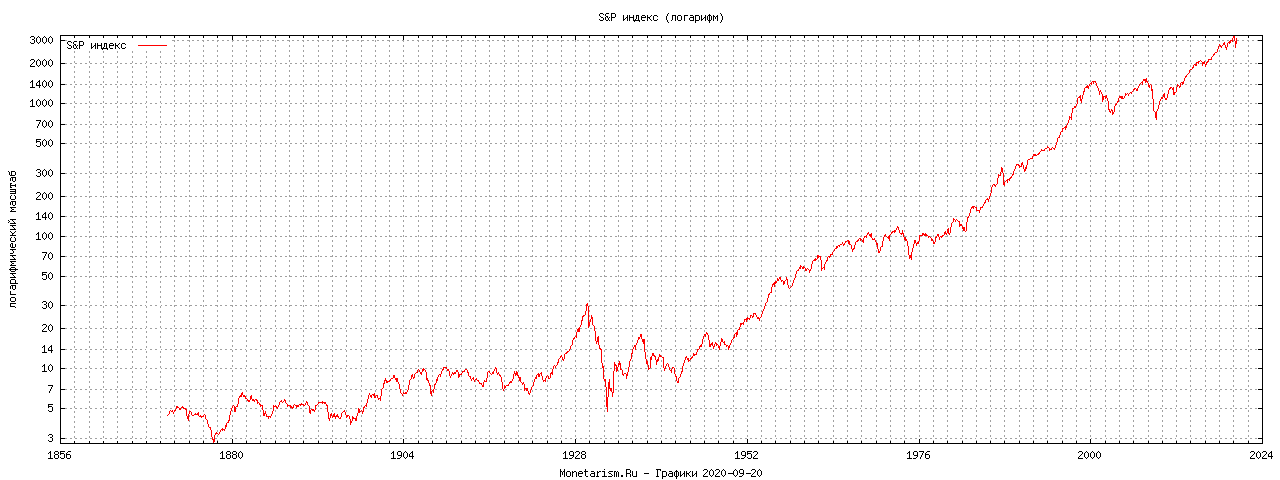

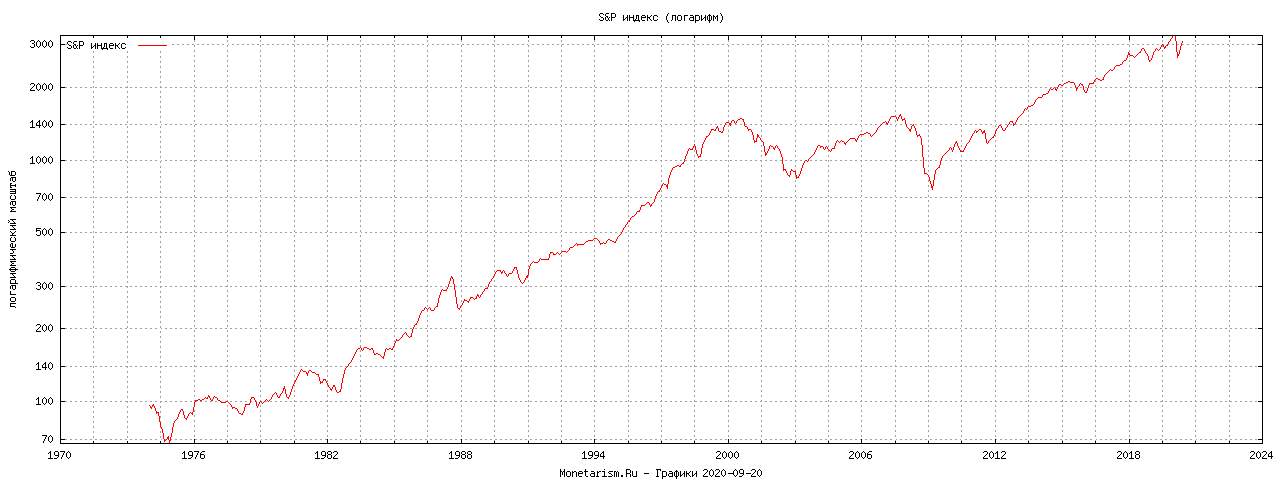

S&P chart SP 1870

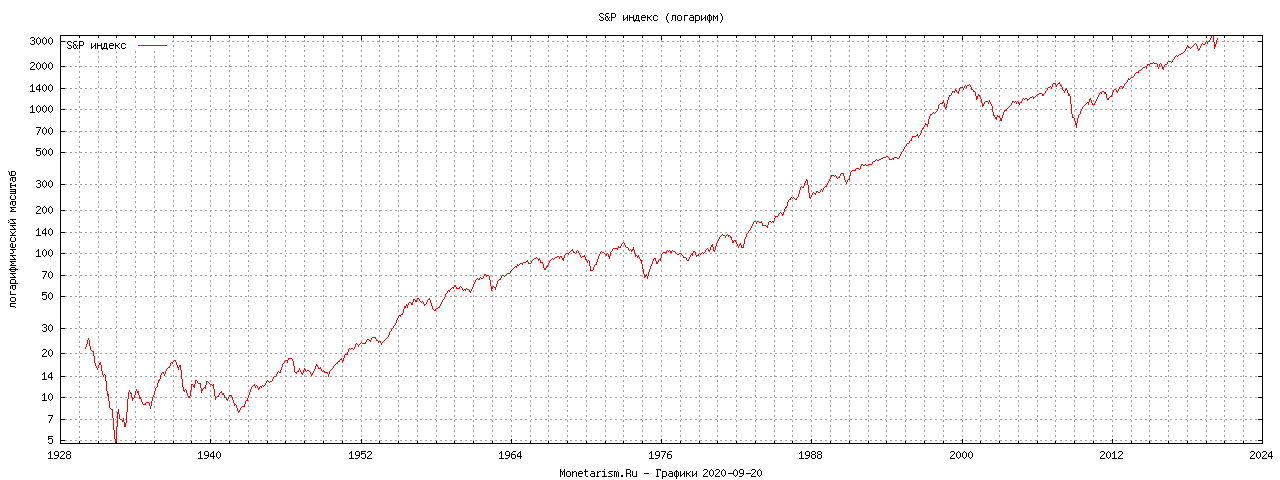

S&P chart SP 1930

S&P chart SP 1974

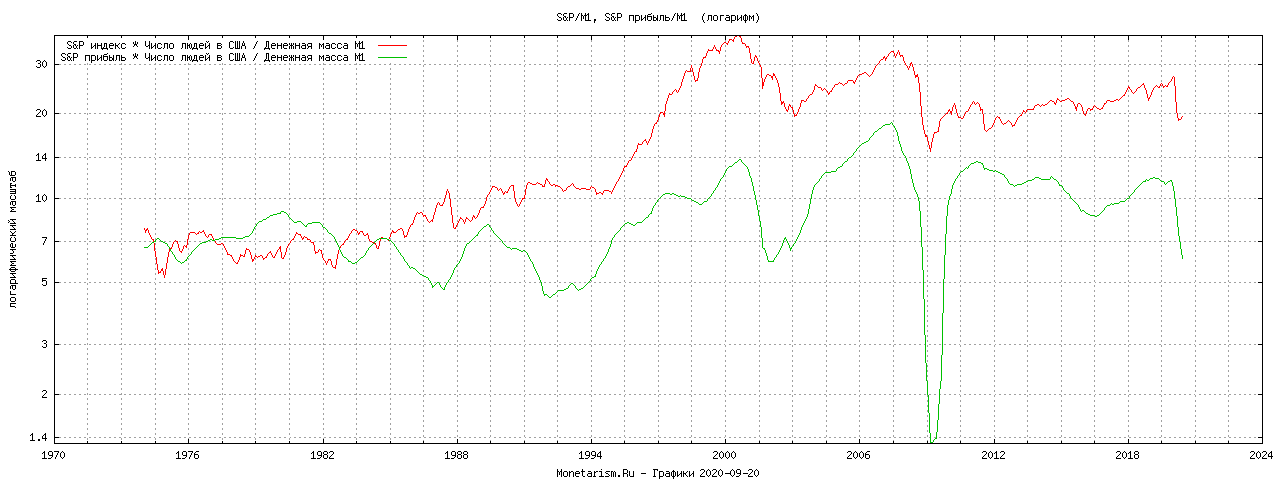

S&P*nPeople/M1 chart SP 1870

S&P*nPeople/M1 chart SP 1930

S&P*nPeople/M1 chart SP 1974

S&P P/E 1870

S&P P/E 1930

S&P P/E 1974

S&P Earnings 1870

S&P Earnings 1930

S&P Earnings 1974

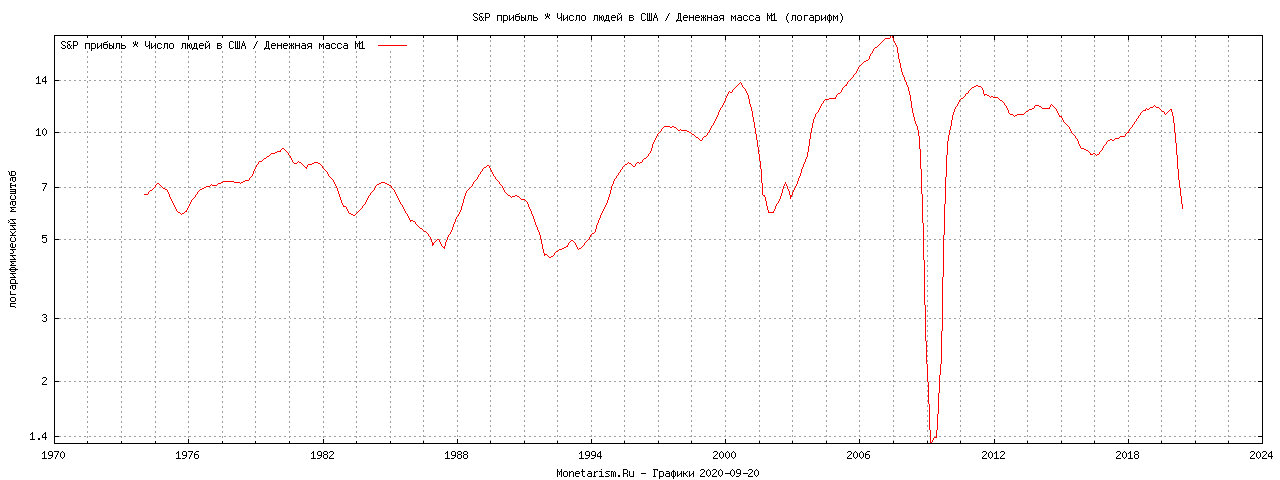

S&P Earnings*nPeople/M1 1870

S&P Earnings*nPeople/M1 1930

S&P Earnings*nPeople/M1 1974